When the Ethereum blockchain moved away from using a technique for verifying transactions known as proof of work last September, crypto market demand for the specialized processors that performed these calculations disappeared virtually overnight.

Companies that used and hosted GPUs, or graphics processing units, saw a key part of their once-booming business vanish against an increasingly difficult backdrop for crypto. But now mining infrastructure companies like Hive Blockchain and Hut 8 Mining are finding opportunities to repurpose their GPU-based equipment for another industry on the precipice of a possible boom: artificial intelligence.

“If you can reapply some of that investment in the GPU mining infrastructure and convert it to new cards and workloads, it makes sense,” Hut 8 Chief Executive Officer Jaime Leverton said in an interview.

GPUs — designed to accelerate graphics rendering — require constant maintenance and physical infrastructure not all users are prepared to provide. As such, Hut 8 and a few other miners have been using the chips to power high-performance computing, or HPC, services for clients across a range of industries. But inroads with the burgeoning and much-hyped AI sector — which requires huge amounts of computing power — represent the kind of transformational opportunity miners had been seeking when they originally bought the processors.

Read more: Bitcoin Rally Is Lifeline for Troubled Miners After Collapse

Hut 8 said its HPC business generated about $16.9 million in 2022 — representing about 11% of overall revenue — after just one year of operations, driven in part by AI clients.

Likewise, Hive Blockchain — which purchased $66 million worth of GPUs from Nvidia Corp. in early 2021 — said it aims to grow its HPC revenue tenfold to $10 million in 2024 and by as much as 20 times current levels by 2025. Currently analysts tracked by Bloomberg are forecasting about $98 million in overall revenue for the company in 2024.

Not all crypto miners are in a position to capitalize on the frenzy around AI or the glut of expensive chips on hand. According to Bitpro Consulting, which offers brokerage services for miners, between 5% and 15% of existing crypto-oriented GPUs can be repurposed for AI and adjacent applications like computer vision and generative graphic design.

Additionally, a pivot toward offering HPC services for AI will require a huge investment in additional hardware and staff, when a lot of miners have been struggling financially with the slide in cryptocurrencies. Core Scientific Inc., the largest public Bitcoin miner by computing power, went bankrupt last year, and multiple miners have warned of liquidity crunches. But it could be a chance to recoup the $15 billion Bitpro estimates miners spent on the processors.

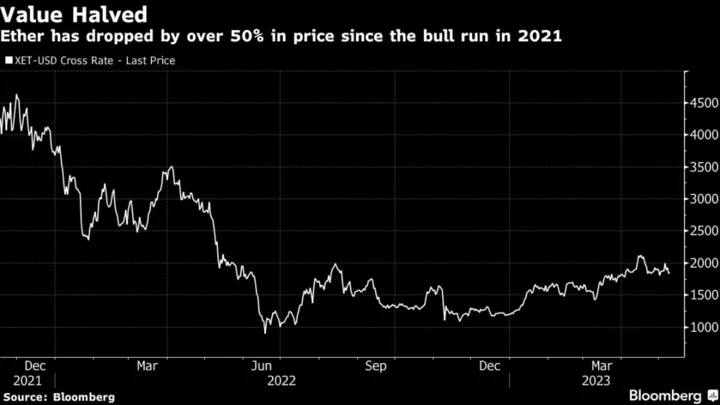

A handful of Ether miners had snapped up the high-end chips when cheaper options were unavailable at the height of the crypto boom in 2021 and early 2022. The miners were willing to pay more for these “over-qualified” processors because of the favorable economics of soaring Ether prices, which touched a high of $4,870 in November 2021. But soon the group found themselves on the wrong side of a bet regarding not only Ether prices but how long the chips would be useful.

Ethereum successfully executed its transition to a proof-of-stake consensus, making the chips unnecessary, in September 2022, not long after Ether had touched a low of $880 following a series of unrelated blowups in the crypto industry.

Ethan Vera — chief operations officer at Luxor Technologies Corp., a Bitcoin-miner products and services company — said it could be difficult for miners to compete with major data service providers like Microsoft Azure or Amazon Web Services. Those platforms already have widely used tooling systems and support staff available to AI clients. However, miners’ experience in energy management could give them an edge, given AI is very energy intensive like crypto mining, he said.

“Miners need to find the competitive advantages they have learned in mining in order to compete in HPC,” Vera said. “For the miners that can successfully pivot part of their business to HPC, that will be quite lucrative. But certainly it won’t be a cakewalk. Only the most proficient and tenacious miners will actually pull it off.”