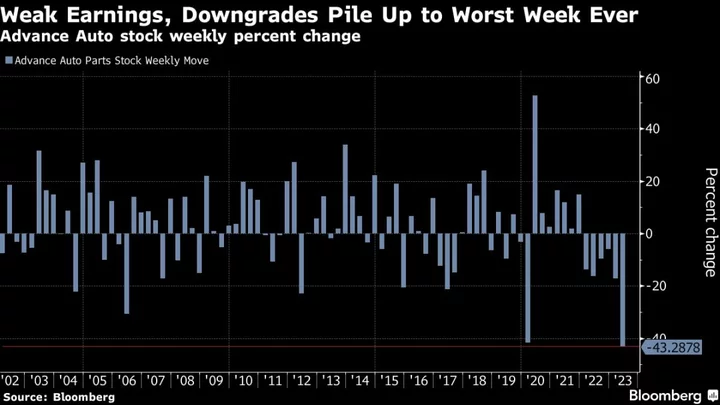

Advance Auto Parts Inc. had its worst weekly performance ever after a weak earnings report and an accounting issue led to a slew of downgrades from Wall Street.

Shares slumped 40% this week, the largest four-day drop since the stock began trading publicly in 2001. The trouble started Wednesday when the auto-parts retailer reported a first quarter earnings miss, lowered its earnings and sales guidance for the full year and reduced its quarterly dividend. The results set off a flurry of price target cuts and a few rating downgrades from analysts.

It was “one of the most challenged prints we have seen in retail for such a modest” earnings miss, Citi analyst Steven Zaccone wrote in a Wednesday note maintaining a neutral rating and cutting its price target to $76 from $126.

Shares tumbled 35% on Wednesday, the largest one-day drop on record. Then the following day, Advance Auto said in a filing with the US Securities and Exchange Commission that it would be unable to file its next Form 10-Q on time after losing “certain accounting personnel.”

“The hits keep coming,” Wells Fargo analyst Zachary Fadem said in a Friday note. He lowered his price target to $70 from $80, the second cut of the week, and maintained his equal weight rating. “Needless to say, the wheels appear to be coming off post-very weak Q1 results.”

Bank of America also exited the bull camp, downgrading Advance Auto to neutral from buy citing faltering turnaround efforts, while Raymond James moved its rating to market perform from a strong buy.

“Even with shares down 35% following F1Q’s report, we have low confidence in where profitability, estimates, and Advance’s market share will bottom, and cannot continue to recommend the stock,” Raymond James analyst Bobby Griffin said in a note, adding that there could be another time to own Advance Auto in the future, as they’re favorable on the overall industry.

RBC Capital Markets still favors the overall auto parts retail industry. The firm maintains its sector perform but slashed its price target on AAP to $84 from $158.

“While shares admittedly look more tempting following the sell-off, visibility into share recapture and the pace/magnitude of margin improvement remains limited — keeping us on the sidelined,” RBC Capital Markets analyst Steven Shemesh wrote in a note.

And, even those that remain bullish on the company have lowered their earnings estimates. Jefferies, one of at least three analysts with buy ratings, significantly reduced its near—term outlook and cut its price target to $84 from $160.

Jefferies said in a note it recommends buying Advance Auto shares “on the belief that execution shortfalls can be contained and margins improved.”

(Updates stock move at market close.)