Malaysia’s government plans to reduce its budget deficit in 2024 through a combination of spending cuts, new taxes and reduced debt payments, as Prime Minister Anwar Ibrahim steps up efforts to convince investors that he’s serious about fiscal discipline.

Anwar, who doubles as the finance minister, proposes to cut the government’s spending to 393.8 billion ringgit ($83.5 billion) next year from a revised 397.1 billion ringgit in the current year, according to a Finance Ministry report. That reduction is due mostly to absence of any debt obligations related to state fund 1MDB in 2024, which in turn will help narrow fiscal deficit — the gap between revenue and expenditure — to 4.3% of gross domestic product from a 5% shortfall this year, the report showed.

The deficit is in line with the median level predicted in a Bloomberg survey of economists.

The government will also trim spending on subsidies and social assistance next year by around 11.5 billion ringgit to a total 52.8 billion ringgit, as it moves toward targeted assistance instead of blanket sops. Anwar is expected to share more details on revenue and expenditure when he presents the annual budget for 2024 in Parliament starting 4 p.m. in Kuala Lumpur.

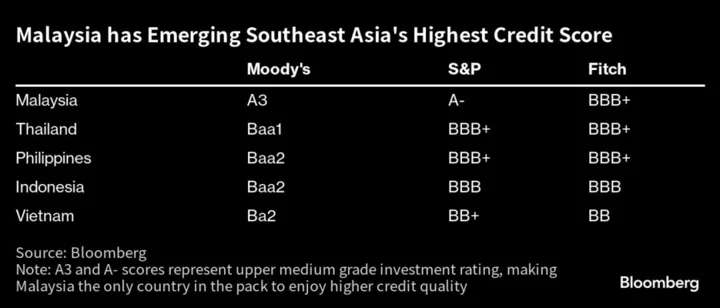

Restoring fiscal health is key for Malaysia to retain emerging Southeast Asia’s highest credit score, and keep investors’ faith at a time when higher US rates have pushed them to ditch emerging-market assets. Foreign funds remain net sellers of about $706.7 million of Malaysian stocks this year, while they have withdrawn a net $114.3 million from the nation’s bonds so far this month, according to data compiled by Bloomberg.

Malaysia also expects revenue to grow 1.5% next year on better economic prospects coupled with measures to broaden the tax base and improve compliance and transparency. The previously-announced capital gains tax for the disposal of unlisted shares by companies will be implemented next year, as well as e-invoicing.

“The government will undertake bold fiscal reform measures to further strengthen revenue management and mobilization, along with efforts to reduce wastages and leakages, as well as optimize spending,” Anwar wrote in the preface of the finance ministry report.

Anwar’s government eventually aims to reduce fiscal deficit to 3.5% of GDP in the medium term, which will pave the way for the government to lower the debt to GDP ratio to 60%. Malaysia sees federal government debt at 64% of GDP by end-2024, with borrowings to be funded entirely onshore, according to the report.

Malaysian parliamentarians on Wednesday approved a bill to impose limits to its fiscal gap, debt levels, and government guarantees. Once gazetted, Malaysia will have to reduce its budget gap to 3% of GDP as well as lower its debt levels to 60% of GDP within three to five years. Anwar’s fiscal plans are part of a broader goal to make the Southeast Asian economy attractive to international investors, while trying to turn it into a high-income nation within this decade.

He proposes to set aside about 90 billion ringgit for development spending in 2024, which will include 2,000 new projects such as the construction of additional lanes for the so-called PLUS highway as well as upgrading roads, according to the report. That outlay will be lower than the 97 billion ringgit earmarked for development expenses this year.

On the ringgit, Malaysia said its good economic fundamentals, expectations of the US Federal Reserve reaching the end of its rate hiking cycle and China’s economic recovery may provide support for the local currency. The ringgit remains near the bottom of Asia’s leaderboard, and Malaysia said the currency would continue to be market-determined.

--With assistance from Cynthia Li.