The world’s biggest shipping companies are plowing their pandemic windfalls into orders for new vessels on an unprecedented scale, making an industry known for hair-raising cycles of boom and bust more vulnerable in the latest downturn.

Container carriers like MSC Mediterranean Shipping Co., A.P. Moller-Maersk A/S, CMA CGM SA and Hapag-Lloyd AG — all backed by European billionaires — are spending record profits gleaned during the health crisis to splash out on new models mostly from Korean and Chinese shipyards. This has pushed the global order pipeline to a historic level — almost $90 billion by one estimate.

But the tide has turned in the notoriously cyclical sector as freight rates flirt with below-breakeven levels and fears about overcapacity re-emerge.

“Too many large container ships have been ordered,” said Erik I. Lassen, chief executive officer of Danish Ship Finance A/S, a company providing vessel financing. He noted that deliveries are now starting at a time when supply chains are running more smoothly and demand for freight transport is back to pre-pandemic levels.

“There will be shipowners — tonnage providers — out there that will have stretched themselves,” he said in an interview. “Although the last couple of years have been profitable for shipping, the accumulated earnings are far from enough to fund the investment in new technology and ships in the coming decade.”

Cloudier Outlook

The outlook has grown cloudier for the tycoons, whose companies have begun a chorus of negative forecasts for the coming months. On Friday, France’s CMA CGM, controlled by billionaire Rodolphe Saade and his family, warned about deteriorated market conditions and said new vessel capacity “is likely to weigh on freight rates.”

Earlier this month, Zim Integrated Shipping Services Ltd. cut its 2023 financial outlook on lower-than-expected volume growth and weak rates. Danish shipping giant Maersk has forecast global container transport volumes may shrink as much as 2.5% this year and has also warned of an emerging supply-side risk in the second half. Germany’s Hapag-Lloyd has said supply will likely outpace demand this year and next.

Matson Inc. — a smaller competitor and a bellwether for goods flowing from China to North America — said on July 20 it expects a “muted peak season” in the months ahead as “retailers continue to carefully manage inventory levels in the face of lower consumer demand.” Honolulu-based Matson announced plans last November to purchase three new vessels for about $1 billion.

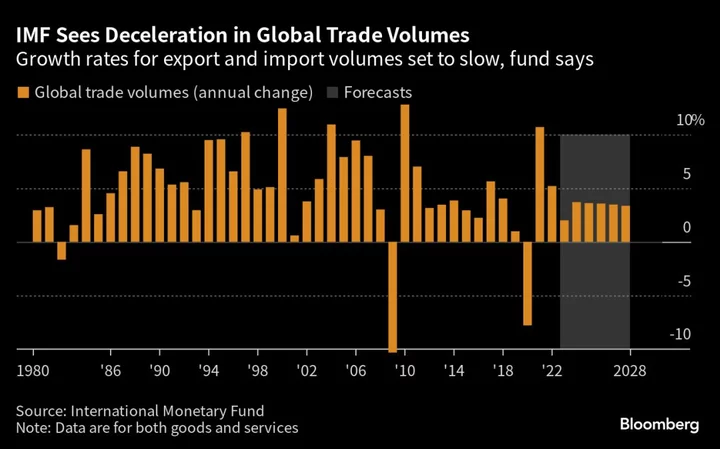

Overall, the International Monetary Fund is predicting trade volumes will grow by just 2% this year, a sharp deceleration from the estimated 5.2% in 2022.

Against this backdrop looms an order book for new container vessels that Drewry Maritime Research put at 890 ships as of July 1, or 28% of the current global capacity worldwide measured in 20-foot equivalent container units.

Deliveries this year alone are expected to add 1.75 million TEUs, or about 6.6% of the total fleet before adjusting for demolitions, according to Drewry’s latest Container Forecaster. Net new capacity is expected to increase by a record 1.82 million TEUs next year and 1.4 million in 2025 to reach 30.5 million, up almost 55% from a decade earlier.

“We’re looking at the biggest order book in container shipping history,” said industry veteran John McCown, the founder of Blue Alpha Capital. “They have cleaned up their balance sheets and are now reinvesting.”

He estimates the pipeline of new vessels will set shipowners back some $89.5 billion based on the cost to build ships of an average size range.

A clutch of European billionaires control some of the world’s biggest container lines including the Saade clan. There’s Switzerland-based Gianluigi Aponte, founder of MSC; Klaus-Michael Kuehne, who has a 30% stake in Hapag-Lloyd; and the family of Maersk Chairman Robert Maersk Uggla, the great-grandson of the founder.

Kuehne is Germany’s richest individual with a net worth of $46 billion, according to the Bloomberg Billionaires Index, while Saade and his family have $23 billion and Aponte $21 billion.

Read more: A $95 Billion Windfall Has Shippers Splurging Before Party Ends

One motivating factor to order new vessels and upgrade the engines of existing ones is to mitigate climate change. The International Maritime Organization wants the industry to be net-zero greenhouse gas emissions by 2050, with checkpoints in 2030 and 2040. The availability of emission-free fuels is virtually zero right now.

Read more: Shipping Regulator Falls Short of 1.5C-Aligned Climate Goals

Maersk last month ordered six methanol-powered container vessels, bringing the total to 25. At the end of last year, Hapag-Lloyd had an order book of 15 new builds with deliveries over the 2023-2025 period.

CMA CGM has built up the world’s second-largest order book at 1.24 million TEUs, putting the French company in a position to get close or even overtake Maersk in 2026, according to industry analyst Alphaliner.

“In recent years, the Marseille-based shipping line has been ultra-aggressive when it comes to placing new-building orders,” Alphaliner said this month in a report, putting the pipeline at 122 vessels and 1.24 million TEUs. No. 1 ranked MSC’s fleet expansion is partly due to purchases of second-hand vessels, it says.

CMA CGM Chief Financial Officer Ramon Fernandez said the company has about 100 vessels on order, with most of them to be fueled by LNG or methanol. He declined to be more specific, but acknowledged the possibility of overcapacity.

“The supply-demand balance for the next period will likely be under pressure because capacity will grow more than trade,” he said, adding that the scrapping and pulling from service of older, more polluting vessels could dampen the effects, along with a move to slow engine speeds to curb emissions.

The plans to build ships hark back to the lead-up to past declines in the sector. CMA CGM was on the brink of default in 2009 when the global financial crisis brought trading to its knees. This time around, though, their coffers are fuller. This is reflected by muted demand for credit, so far.

Bank lending, traditionally one of the main sources of funding for the industry, didn’t increase in line with the order book last year and could remain flat in 2023, Petrofin Research said in its annual report on global ship financing. Furthermore, a two-tier credit market has emerged with lenders offering better terms for vessels with lower emissions.

“Ship owners are becoming more and more like banks and use the risk mindsets you see at banks,” Lassen said. “They are becoming a lot more sophisticated than the general picture you might have of the old days of ‘buy cheap and sell expensive’.”